the December 5th ballot propositions

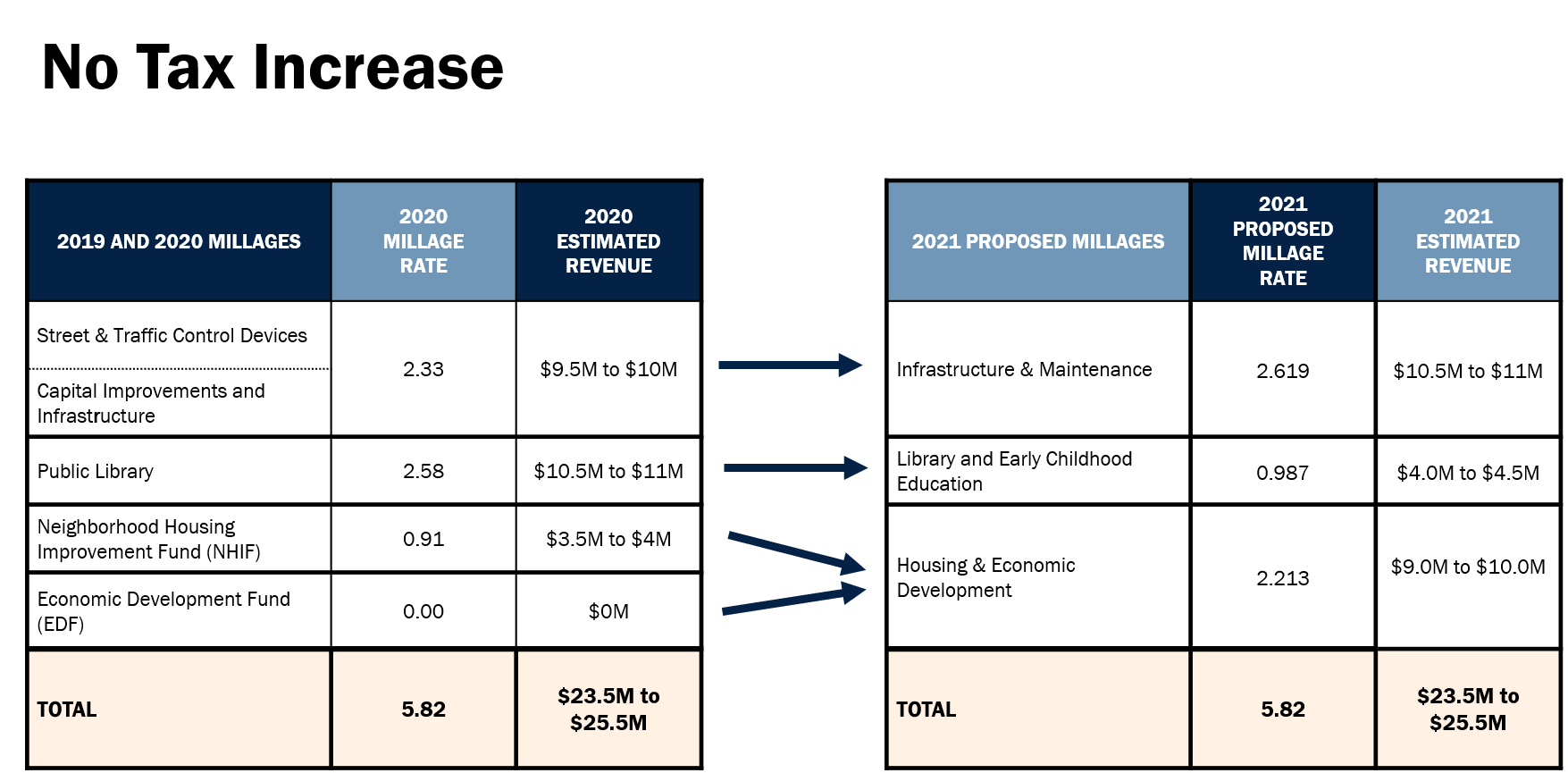

infrastructure and maintenance millage

Yes for Local Progress

This millage will provide maintenance and repair of existing roads, streets, bridges, drainage systems, and facilities. It will also provide for the purchase of vehicles, computers, software, and other items that are necessary for the services the City provides to the public.

Ballot Language:

In lieu of separate millages previously approved by voters in the City of New Orleans ("City") in the amount of 1.900 mills for street and traffic control device maintenance and 2.500 mills for the Capital Improvements and Infrastructure Trust Fund (collectively, “Prior Taxes”), shall the City be authorized to levy a special tax of 2.619 mills ("Tax") for twenty years, January 1, 2021 - December 31, 2040 (estimated at $10,500,000 in the first year) with the proceeds of the Tax dedicated first to payment of debt service obligations secured by any of the Prior Taxes and then solely to public infrastructure in the City, to be used for the purposes of repairing, improving, maintaining and operating (i) roads, streets, and bridges, (ii) surface and subsurface drainage systems and stormwater management facilities, and (iii) public buildings and public safety facilities of the City, including purchasing related equipment and vehicles for any of the foregoing, provided that a portion of the monies collected shall be remitted to certain state and statewide retirement systems in the manner required by law?

early childhood education/ library millage

Yes for Children's Success

For the first time ever, New Orleans will join other progressive cities around the country in allocating dedicated funding to early childhood care and education. By investing in early childhood education, we are investing not only in New Orleans families, but also in our local economy.

This measure will also renew library funding with an adjustment so that the library’s budget fits its real expenses and revenue. At the moment, the New Orleans Public Library system has $14.5M in reserves.

Ballot Language:

In lieu of a separate millage previously approved by voters in the City of New Orleans ("City") in the amount of 4.000 mills for the support of public libraries in the City (“Prior Tax”), shall the City be authorized to levy a special tax of 0.987 mills ("Tax") for twenty years, January 1, 2021 - December 31, 2040 (estimated at $4,000,000 in the first year) with the proceeds of the Tax to be used for the purposes of constructing, improving, maintaining and operating public libraries and early childhood education facilities and related programs in the City, including the purchase of equipment therefor, title to which shall remain in the public, provided that a portion of the monies collected shall be remitted to certain state and statewide retirement systems in the manner required by law?

housing and economic development millage

Yes for Housing and Income Security

This millage will help provide affordable housing for New Orleans residents through programs including rental housing development, homeownership support, permanent land trusts, program client support, housing related plans/studies, and a HOME match requirement. It will also provide for economic development including investing in the City’s own economic and workforce development capacity and priority industries and projects, reimagining the partnership with the New Orleans Business Alliance, workforce development and readiness programs, and the Commercial Corridor Revitalization Program.

Ballot language:

In lieu of a separate millage previously approved by voters in the City of New Orleans ("City") in the amount of 2.50 mills to fund the Housing and Economic Development Trust Fund in the City (“Prior Tax”), shall the City be authorized to levy for twenty years, January 1, 2021 - December 31, 2040, special taxes of (a) 1.05 mills (estimated at $4,250,000 in the first year) to be used for the purpose of constructing, acquiring, improving, maintaining and operating affordable housing facilities and alleviating urban blight, and (b) 1.164 mills (estimated at $4,600,000 in the first year) to be used to support economic development activities in the City, provided that a portion of the monies collected shall be remitted to certain state and statewide retirement systems in the manner required by law?

JOIN OUR MAILING LIST

We will get back to you as soon as possible

Please try again later

Get updates.

We will get back to you as soon as possible

Please try again later